The first transaction that involves the bank account occurs on the 1st of April, where Mr. Burnham invested $15,000 in the business. Let’s take our previous transactions relating to the bank account and see how this would be used to draw up the bank T-account. Now, there can be a number of different ledgers, each one dealing with a specific aspect of the business and listing T-accounts only in that category. According to the Collins English Dictionary, the ledger is “the principal book in which the commercial transactions of a company are recorded.” If you’ve been studying accounting for even a short amount of time then you’ve probably heard of T-accounts and ledgers.

Expenses

- Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year).

- A review of the checking account of a company showed a beginning balance of $500, total deposits of $1,500 and total withdrawals of $700 as shown in the T-account above.

- Your profit and loss organises your revenue and expense accounts whilst your balance sheet organises your asset, liability and equity accounts.

- We see from the adjusted trial balance that our revenue account has a credit balance.

- Contra-expense Accounts are expense accounts with a normal credit balance as opposed to the normal debit balance that expense accounts typically have.

- There is no hard and fast rule for when to use the different terminology.

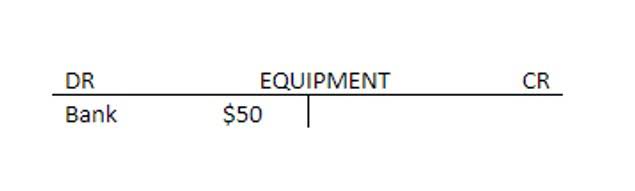

For example, asset accounts increase with a debit and thus normally have a debit balance. This simple structure provides a clear and immediate way to track increases and decreases in a specific financial account, such as cash, accounts payable, or sales revenue. T accounts make it easier to manage a double-entry bookkeeping system.

- Let’s deep dive into the world of accounts receivable and learn the fundamentals of mastering T accounts.

- Expense accounts – Cost of Sales, Utilities Expense, Wages or Salaries Expense, Rent Expense, Interest Expense, Advertising Expense, Depreciation Expense, and Loss on Sale of Equipment.

- And best of all, we have an Excel template and a PDF available for free download.

- On the other hand, credit entries decrease accounts on the left side of the equation while debit entries decrease accounts on the right side of the equation.

- Using T accounts, you’ve figured out where everything goes, so you can record this transaction in your accounting software.

- T-accounts, in contrast, are visual tools used to analyze how transactions impact individual accounts.

Office Expense Account

The transactions show a debit balance of 500 for rent and a accounting credit balance of 500 for the bank. T accounts help you total the debits and credits for each of these accounts. The final balances are then used to calculate your net profit or loss. Students can use T accounts to learn about accounting and how transactions affect different accounts on the general ledger using the double entry system.

T-Account: Definition, Example, Recording, and Benefits

You do this by using a T-account with debits on the left and credits on the right. A T-account is a visual representation of a financial account for a financial accounting period. If you want to get started in business accounts, a T-account template is one of the best ways to do so. This allows you to track your accounts’ activity, giving you a more detailed understanding of your financial standing. And best of all, we have an Excel template and a PDF available for free download.

How to Post Journal Entries to T-Accounts or Ledger Accounts

A T-account is a simple way to show how transactions affect different accounts in bookkeeping. It looks like a “T”, with debits on the left and credits on the right. At the top of the spreadsheet, the total debits and credits for all the accounts are shown. It means that every financial transaction affects at least two accounts—one side is a debit, and the other is a credit. This system helps keep your books balanced and ensures nothing is missed. Notice how the $75 debit to cash is perfectly balanced by the $75 credit to sales revenue.

AML made easy – the seven golden rules of successful compliance

A T account ledger is an informal way of addressing a double-entry bookkeeping system. On the top, the name of the ledger is mentioned, the left side is for debit entries, and the right side is for credit entries within the ledger. It is essentially a visual or graphical representation of the company’s accounts which can be used to present, scrutinize, or review. It’s true that you can make a T account for any account but let’s t accounts take an account like cash. If you were to get cash coming in, you would add it to the debit side of the “T” account.

Easy T Accounts For Small Businesses

The debits for each transaction are posted on the left side while the credits are posted on the right side. double declining balance depreciation method In this example, the column balances are tallied, so you can understand how the T-accounts work. The account balances are calculated by adding the debit and credit columns together. This sum is typically displayed at the bottom of the corresponding side of the account. Since management uses these ledger accounts, journal entries are posted to the ledger accounts regularly.

- As the business will be paying for the coffee machine in the following month, the accounts payable is increased (credited) by £700.

- So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand.

- So, the total debits must always balance the total credits to balance the books.

- This account will show all checking account deposits as increases to the Cash in Bank account and all cash withdrawals or check payments as decreases.

- If Barnes & Noble Inc. sold $20,000 worth of books, it debits its cash account $20,000 and credits its books or inventory account $20,000.

- On the left-side of the vertical line, the debit amounts are shown.

For example, if you add $1,000 of cash coming in (a debit), with $500 cash going out (a credit). To pay the rent, the business has used cash, so the bank account (an asset account) is credited by £2,000. While many businesses rely on accounting software today, understanding T-accounts remains essential for financial accuracy and decision-making. T-accounts break down transactions into clear debit and credit entries, making it easier to follow the movement of money.

This entry of the T-account example properly records the wage expense and cash outflow, keeping the accounting equation balanced. This entry ensures the accounting T-account equation remains balanced by recording the cash collection and reducing the receivable. This entry balances the accounting T-account equation by increasing assets and revenues. Whether you use T accounts, a general ledger, or both to record every transaction, that’s only the start of monitoring and forecasting your financials. These are essential elements of the continued success of any business.

Each ledger account is classified as an asset, a liability or an equity. T Accounts allows businesses that use double entry to distinguish easily between those debits and credits. The main thing you need to know about debit and credit entries is that they are the equal and opposite sides of a financial transaction. They’re simply words representing where cash is coming from, and where it’s flowing to, within a business. T-accounts help you understand how money flows in and out of each account. They’re especially useful when creating journal entries, as they give a clear visual of how each transaction affects your business’s finances.

Leave a Reply